26+ Snowball payoff calculator

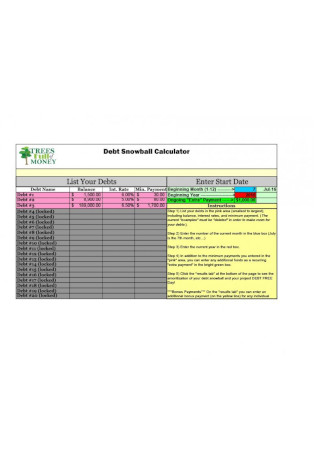

Your total minimum monthly payments equal 275. Using the debt snowball calculator is super easy.

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Welcome to the debt snowballavalanche payoff calculator.

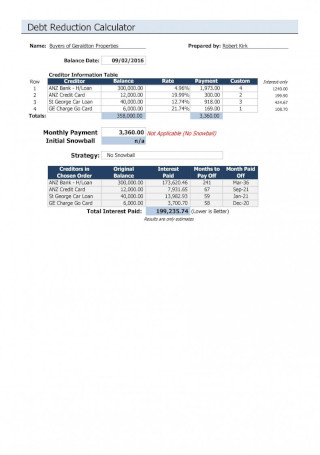

. Our debt snowball calculator shows the amount of time you could save paying off debts as well as the money saved. If you continue to pay just the minimum on both accounts the calculator shows that it will take you 12709 and 47 months. Our Resources Can Help You Decide Between Taxable Vs.

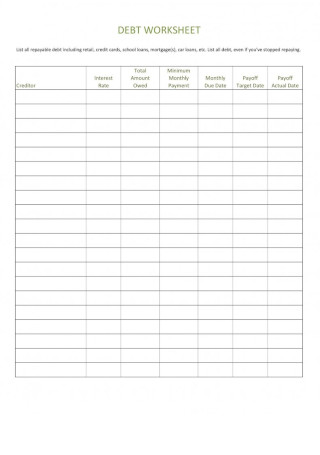

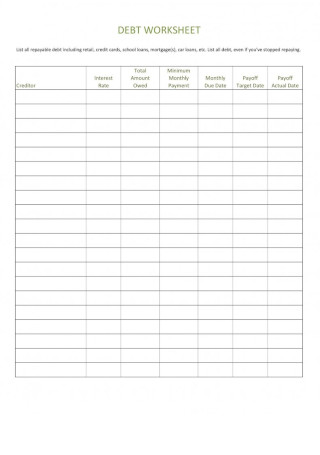

Ordered from smallest balance to highest balance enter the name current balance interest rate and minimum. The name of the lender. You start by inputting all of your current debt information.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. It uses the rollover method. The debt snowball method is designed to keep you motivated and pay off debts quickly and consistently.

This free tool enables you to enter all of your debts and compare the payoff scenarios between the debt snowball and debt. Notice in the above example that the extra is added to the payment for debt 1. Our debt snowball calculator can help you master the snowball.

While the calculator uses the Debt Avalanche method the Debt Snowball method is an alternative for people who cannot find success using the former. Add each form of debt that you haveexcluding mortgageswith the account type remaining balance interest rate and minimum payment due each month. The first thing you need to enter is your Total debt payoff budget.

Change Debt 1 to your debt title like Amex. First things first enter all your debts into the debt snowball template. Its really easty to get started.

Accelerated Debt Repayment Calculator. Start with your smallest debt and insert it on the far left. This is the total amount you can pay towards your debts each.

This is how this method works you pay off a. It will list whatever you list as number 1 first in the snowball. How to Use This Calculator.

The calculator will ask you for. At payment 7 what is left is applied to debt 2. Plug in your debt details.

The calculator below estimates the amount of time required to pay back one or more debts. Additionally it gives users the most cost-efficient payoff sequence with the option of adding.

Free Google Docs Budget Templates Smartsheet Household Budget Template Budget Template Budget Template Free

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Business Plan Template Vertex Ten Precautions You Must Take Before Attending Business Plan T Business Budget Template Excel Budget Template Budget Template

Household Budget Worksheet For Excel

Bi Weekly Pay Budget Template Weekly Budget Template Budget Template Weekly Budget

Download Personal Loan Agreement Template Pdf Rtf Word Doc Wikidownload Personal Loans Contract Template Loan Application

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Financial Risk Types Of Financial Risk Advantages And Disadvantages

23 Free Bi Weekly Budget Templates Ms Office Documents Weekly Budget Template Excel Budget Template Excel Budget

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Embroidery Order Form Template Inspirational T Shirt Order Form Template Excel Order Form Template Tshirt Template Shirt Order

Bi Weekly Budget Worksheet Simple Monthly Budget Template Simple Monthly Budget Tem Budget Spreadsheet Template Budgeting Worksheets Weekly Budget Template

Realtor Business Plan Template Luxury Free 7 Sample Retail Business Plan Templates In Retail Business Plan Template Business Plan Template Retail Business Plan

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Timeline Infographics Timeline Design Infographic Infographic Design